Every trade, you take or decide to give a pass, is an experiment. After every experiment you gather some data points and make observations based on that. Over the period these observations make you better in finding right and highly rewarding trades at low risk entry point. Today we will be talking about three textile plays and what lessons we can learn from them.

It was Dec 08, 2020 and market was not giving any clean signal but there were certain emerging trends. One of these trend was textile stocks doing good.

We posted this chart for Arvind Fashion back then at 150

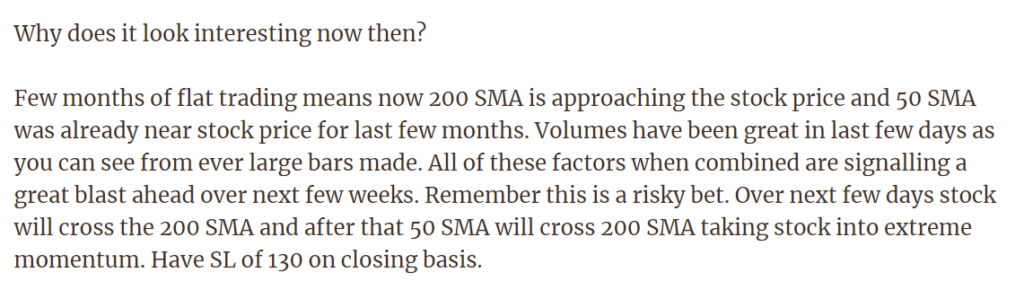

Along with below comment –

Look at how it has panned out and correlate it with what we said above –

Next we discussed Indo Count trading at 160 and below chart was posted –

It had stop loss of 147.5

Here is how it looks now –

After hitting stop loss if you did not exit stock gave good feeling for few days since it rallied towards 160 but only to disappoint later and now trading as low as 120s.

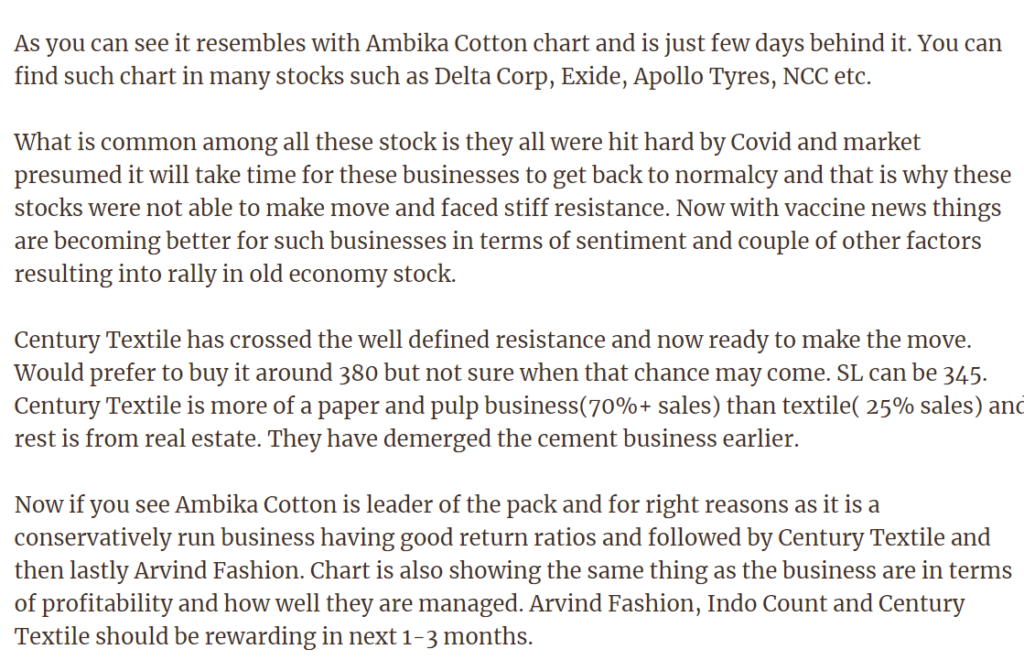

Third stock that we discussed has textile in its name although it is more of other business than textile – Century Textile at 390

This was the analysis posted for Century back then –

How are things now for Century Textile –

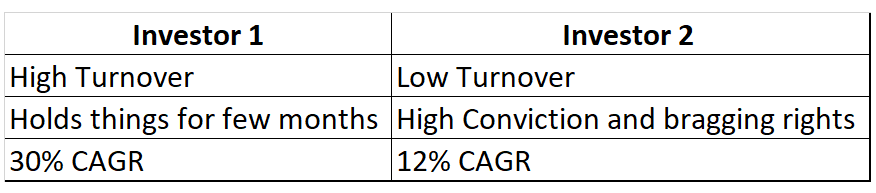

Stock went very close to our SL and reversed. If you are day trading then you can not have that deep stop loss and as a result you will hit stops very frequently which may even demoralize you to accept the long term value investing dropping your returns from 30% CAGR to 15% CAGR if all goes right with possibility of worse can always happen.

Century Textile is example illustrating what we tweeted today –

This is why we do not have to know exact bottom or top or exact price movement at any specific point in time. All we need is broad direction with ups and downs and we will make good money.

Here is how tracker looks like for these three –

Notice that ICIL hitting our Stop and then exit was best strategy because now stock is well below that level. While other two ideas are doing fine and still developing on upside.

We did not post the analysis of ICIL because it was a simple snake pattern which members are familiar with.

Lesson – Follow the process you have. If it says you are wrong then exit. Do not argue and try to find justification. Before trade starts accept the risk and imagine you are going to lose in this trade and now take the trade. Market is probabilistic game and nobody knows what might happen in next trade but over all if you have got good process with edge and executed well then you will come out as winner. It is not about individual trades as much as about over all how you have done over 3 months or 6 months. Hard for most people to get this mental framework specially those who believe they know better than most and based on their understanding of business of the company they also know what stock price must do. Accept your ignorance. To save you from catastrophe you have the red line of stop loss in every trade that you take. But if you believe you are some superior human who knows what is going on then why would you need that red line of stop loss. Because you already know everything about stock and there is no risk. Result will be enormous pain and big drawdowns in portfolio while delivering sub par returns.

You have to stop fearing the labels that people put on you. If they call you trader or speculator then you should not take that as negative and try to explain why you are not. Let them call you what they like but if it works for you then just do it.

Impressive thesis, high conviction, deep analysis, scuttlebutt, High IQ tweets may sound great but if they are not able to translate into returns at portfolio level then they are clearly of no use.

The only way to judge the performance of any market participant is Portfolio CAGR.

Given a choice what would you like to be – Investor 1 or Investor 2? Tell us in comment section.