Life is game of probability. This includes where you are currently in career, what education you have, what kind of lifestyle you have. With few changes it could have been vastly different than what it is today.

Probability is what are the chance of something happening.

Many people confuse probability as simply number of favourable outcomes being high means having high probability of success. You have to see individually about those possible outcomes and how likely they are.

You can say if you buy a stock it has two possibility only – either it goes up or it goes down. It is almost impossible that it will remain at the exact same price at what you bought for any meaningful time after the purchase is done. Now does this mean probability of you making profit is 50%? No.

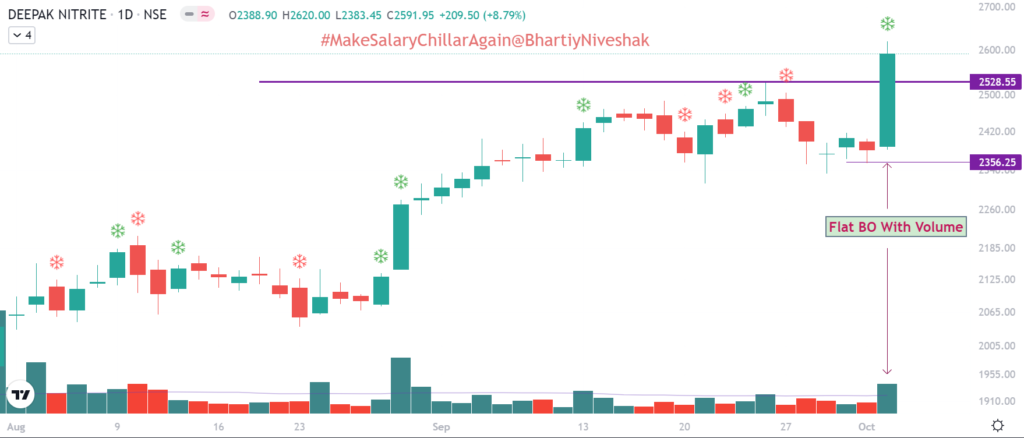

If you put some rules like buying stocks that are trading at All Time High, 52 Week High, Gave Break Out, or are At Support then chance of stock going up after your buy is much more than it going down. By just doing this simple thing you can vastly improve chances of making profits from your trades. How much profit you will make is still not decided by this but in how many trades you will make profit has improved already.

Now add another condition of how long it has been in a range which people call consolidation. Longer a stock has been in consolidation and then makes All Time High, 52 Week High, Gave Break Out, or are At Support then not only chance of it giving you profits becomes higher but the quantum of profits also becomes higher.

The probability that people keep talking about is entirely different from what it actually is. And if you add new conditions and ask them to see new probability then it becomes even harder. Mathematically it is called Bayes Theorem and famous problem on this is Monty Hall problem.

Another thing to understand is just because something has probability of 0.01 then it does not mean it can not happen. By definition, if something has probability greater than 0 then it means it can still happen though likelihood of it happening is quite less. If anything has probability of 0 then it is simply impossible event and it can not happen and if something has probability of 1 then it is simply certain event and this will happen no matter what.

Riding a stock that is showing sign of strength has higher probability to work than a stock that is showing weakness. Always remember, wherever a stock is it is there for a reason. A stock that is at highs can go higher and a stock that is at lows can go lower. And probabilities favour the movement on the same side for bulk of the time.

Getting out of “too high” or “too low” mindset is the first thing you must do to succeed in the market.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. We may have positions in the stock mentioned. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.