In trading, you have to be defensive and aggressive at the same time. If you are not aggressive, you are not going to make money, and if you are not defensive, you are not going to keep the money. Trade off between the two is like walking on a tight rope. With every new event…

Daily Dose #StocksToWatch #12

Please note that below shared chart analysis is our way of sharing market pulse using four stocks. If you are taking trade on any of the stocks mentioned ensure that you have looked at things from all the angles and only after assessing the risk you are doing something.

Company is into business of residential real estate development from Affordable to Premium & Uber-luxury space in NCR and MMR region. It is no more IndiaBulls company with Blackstone and Embassy in the fray and Sameer Gahlaut out of the picture. Discussed here.

They are into media business with 16 channels and in more than 15 languages with 60 Cr+ unique viewers. It is Reliance group company.

Part of the RP-Sanjiv Goenka Group, Firstsource provides bespoke services and solutions to its customers across Banking and Financial Services, Healthcare, Communications, Media and Technology and other diverse industries. It serves to 100+ global clients from 36 delivery centres across four geographies – US, UK, Philippines and India.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Daily Dose #StocksToWatch #11

Please note that below shared chart analysis is our way of sharing market pulse using four stocks. If you are taking trade on any of the stocks mentioned ensure that you have looked at things from all the angles and only after assessing the risk you are doing something.

They are into the business of manufacturing and selling of aluminium die casting (including alloy wheel), suspension, transmission and braking products.

Venkys (India) is into business of production of SPF eggs, chicken and eggs processing, broiler and layer breeding, animal health products, Poultry feed & equipment, and soya bean extract etc.

They are into broking business in Indian financial market space with technology as their main focus.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. We may have positions in the stock mentioned. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Daily Dose #StocksToWatch #10

Please note that below shared chart analysis is our way of sharing market pulse using four stocks. If you are taking trade on any of the stocks mentioned ensure that you have looked at things from all the angles and only after assessing the risk you are doing something.

The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminium, iron ore and oil & gas. with presence across India, South Africa, Namibia, Ireland, Liberia & UAE. Segments – Aluminum Business (~33% of revenues), Zinc, Lead & Silver (~28% of revenues), Copper Business (~13% of revenues), Oil & Gas (~9% of revenues), Power Segment (~6% of revenues), Iron Ore Segment (~5% of revenues), Other Businesses (~6% of revenues).

In Oct 2020 promoter tried to delist it but failed and then over next two quarter they increased their stake from 50% to 65%. First they got 5% in Dec 2020 and then by April 2021 they increased it further by 10%. Promoter wanted to delist it near ₹160 but LIC and some others wanted it to delist at ₹320. 90% shares were not tendered as required by law and it failed. Then prevailing prices were near ₹100 only.

They cater to some big international brands like GAP, H&M, Walmart, Calvin Klein, Tommy Hilfiger, and so on and are present in 58 countries. They are engaged in the business of manufacturing Yarn, Fabric, Acrylic Fiber and Garments. More details here.

TVS Motor Company is engaged in the business of manufactures two wheelers, three wheelers, parts and accessories thereof. With sentiment change and revival in auto this can surprise you. More details here.

Details here in this video.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Daily Dose #StocksToWatch #9

Please note that below shared chart analysis is our way of sharing market pulse using four stocks. If you are taking trade on any of the stocks mentioned ensure that you have looked at things from all the angles and only after assessing the risk you are doing something.

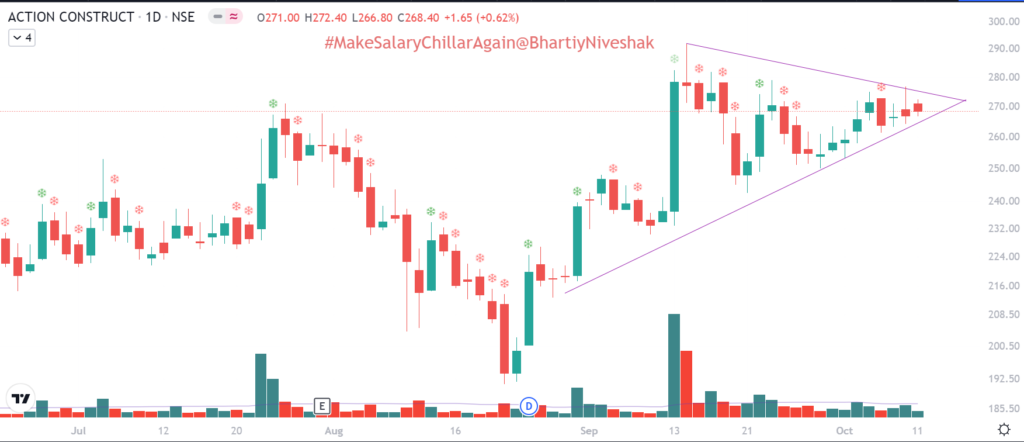

Action Construction Equipment Ltd is engaged in the business of manufacturing and marketing of hydraulic mobile cranes, mobile tower cranes, material handling equipment like forklifts, road construction equipment like backhoe loaders, compactors, motor graders and agriculture equipment like tractors, harvesters, rotavators, etc. They are largest in Pick & Carry cranes in India. Company’s clients include L&T, Tata, Ashoka Buildcon, Aditya Birla, ACC, Dabur, Novartis, HP, BHEL, Coal India, RITES, Indian Oil, BEML etc.

They are into contract manufacturing of air conditioning solutions. They serve all top 10 room ac brands in India and clients include MNCs such as Amazon, Samsung, Domestic such as Flipkart, Godrej, Railways and Metros via BEML, CLW, DMRC, Defense such as Bharat Electronics Limited, Telecom (Department of Telecom), and Buses (Original Equipment Manufacturers).

The Company operates in two segments globally – Human Resources Operation (HRO) covering HRMS, payroll services, time and attendance management and statutory compliance support services to its client, and Customer Lifecycle Management (CLM) which encompasses lead generation, customer retention and relationship management comprising both voice and non-voice processes. It is a subsidiary of another listed company called Quess Corp which has Fairfax of Prem Watsa fame as promoter. Watsa is an IITian living in Canada famous as Warren Buffet of Canada.

They serve electrification industry with conductors, specialty oils used in transformers, power and telecom cables etc.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. We may have positions in the stock mentioned. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Game of Probability

Life is game of probability. This includes where you are currently in career, what education you have, what kind of lifestyle you have. With few changes it could have been vastly different than what it is today.

Probability is what are the chance of something happening.

Many people confuse probability as simply number of favourable outcomes being high means having high probability of success. You have to see individually about those possible outcomes and how likely they are.

You can say if you buy a stock it has two possibility only – either it goes up or it goes down. It is almost impossible that it will remain at the exact same price at what you bought for any meaningful time after the purchase is done. Now does this mean probability of you making profit is 50%? No.

If you put some rules like buying stocks that are trading at All Time High, 52 Week High, Gave Break Out, or are At Support then chance of stock going up after your buy is much more than it going down. By just doing this simple thing you can vastly improve chances of making profits from your trades. How much profit you will make is still not decided by this but in how many trades you will make profit has improved already.

Now add another condition of how long it has been in a range which people call consolidation. Longer a stock has been in consolidation and then makes All Time High, 52 Week High, Gave Break Out, or are At Support then not only chance of it giving you profits becomes higher but the quantum of profits also becomes higher.

The probability that people keep talking about is entirely different from what it actually is. And if you add new conditions and ask them to see new probability then it becomes even harder. Mathematically it is called Bayes Theorem and famous problem on this is Monty Hall problem.

Another thing to understand is just because something has probability of 0.01 then it does not mean it can not happen. By definition, if something has probability greater than 0 then it means it can still happen though likelihood of it happening is quite less. If anything has probability of 0 then it is simply impossible event and it can not happen and if something has probability of 1 then it is simply certain event and this will happen no matter what.

Riding a stock that is showing sign of strength has higher probability to work than a stock that is showing weakness. Always remember, wherever a stock is it is there for a reason. A stock that is at highs can go higher and a stock that is at lows can go lower. And probabilities favour the movement on the same side for bulk of the time.

Getting out of “too high” or “too low” mindset is the first thing you must do to succeed in the market.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. We may have positions in the stock mentioned. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Classic IPO Logic Trades

IPO is like birth of the company in public space. That day decides the kundali of the stock and how it might behave in future. Those levels that it marks on first day become defining characteristics of the stock for foreseeable future and even if in distant future stock comes close to those levels it…

Daily Dose #StocksToWatch #8

Please note that below shared chart analysis is our way of sharing market pulse using four stocks. If you are taking trade on any of the stocks mentioned ensure that you have looked at things from all the angles and only after assessing the risk you are doing something.

The company owns and operates many brands including Mainland China, Asia Kitchen, Oh! Calcutta, Sigree, Sweet Bengal, Hoppipola, Haka, Riyasat, Episode One, UDP HAY & BARrish etc. SRL is one of the largest fine-dining restaurant chains in India and is play on unlock the economy theme with no expectation of third wave of covid.

Filatex India is manufacturer of Polyester Chips, Polyester/Nylon/Polypropylene Multi & Mono Filament Yarn and Narrow Fabrics.

Vijaya and Dena Bank has been merged into Bank of Baroda which has 9,500 branches and 13,400 ATMs operating across the country. After State Bank of India it is second largest Public Sector Bank in India.

First and largest B2B digital marketplace of India commanding over 60% market share. Caters to 56 industries and as many as 7.1 Cr products. It is subscription based business model where sellers pay to use the platform and company also holds stake in software platform Vyapar engaged in accounting needs, invoicing and inventory.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Daily Dose #StocksToWatch #7

Please note that below shared chart analysis is our way of sharing market pulse using four stocks. If you are taking trade on any of the stocks mentioned ensure that you have looked at things from all the angles and only after assessing the risk you are doing something.

Page Industries is the exclusive licensee of JOCKEY International Inc. for manufacturing, distribution and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal and the UAE. They are also exclusive licensee of Speedo International Ltd. for the manufacturing, marketing and distribution of the Speedo brand in India.

Inke bare me ab kya kahna hai. Auto we talked yesterday in our telegram discussion and today index itself was up by more than 5.5% during the day. You can listen it on YouTube.

SBI Cards & Payment Services is engaged in the business of issuing credit cards to consumers in India.

A leader in mechanical control cables in India holding 65% market share. Watch for details here.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.

Three Gems From Developing Themes

There are tons of strategies, systems, processes, ways to make money in the market. Question is do you understand the system, how it works and whether it suits you temperamentally. This unfortunately is easier said than done. But you still have to figure yourself out and then adopt a strategy suited to your nature. After…