Cash is king in the world of business. And one of the keys to a company’s financial success is the management of its working capital. The length of time it takes to turn inventory into cash and collect on accounts receivable can have a significant impact on a company’s cash flow and profitability. That’s why reducing working capital days is such an important goal for many businesses.

Working capital refers to the amount of money that a company has available to fund its day-to-day operations. It is calculated as the difference between a company’s current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable and short-term debt).

Working capital is a measure of a company’s liquidity, or its ability to meet its short-term financial obligations. A company with strong working capital can easily pay its bills and invest in growth opportunities, while a company with weak working capital may struggle to keep up with its financial obligations and may need to resort to borrowing to fund its operations.

Effective management of working capital is crucial for a company’s financial health and can have a significant impact on its profitability and growth prospects.

Let’s say that Company ABC has ₹1,00,000 in current assets, including ₹40,000 in cash, ₹50,000 in inventory, and ₹10,000 in accounts receivable. Company ABC also has ₹60,000 in current liabilities, including ₹20,000 in accounts payable and ₹40,000 in short-term debt.

To calculate Company ABC’s working capital, we would subtract its current liabilities from its current assets:

Working capital = Current assets – Current liabilities Working capital = ₹1,00,000 – ₹60,000 Working capital = ₹40,000

On the face of it, it looks like higher the working capital better it will be because you will have more current assets than current liabilities hence more cash to pay the bills or invest in running operations or for growth. But that is not true.

Negative working capital is better than positive working capital. Negative working capital signals the power of the business to defer the payment of its suppliers and vendors while it collects the money from its consumers early and does not hold the inventory for long. Such businesses produce more cash than their profits often because of this characteristic.

Say you are running a retail business where you collect the payment as soon as you sell things, but you pay to your supplier 30 days later and on an average, you sell your stuff in a week then that will lead to negative working capital. Your customers pay you instantly showing your power while you pay a month later again shows your power.

This is Jagsonpal pharma. This was bought out by Infinity Group and announcement to that effect came on February 21, 2022.

Look at how debtor days (number of days they receive money) has reduced from 100 to 25 in last decade. Inventory used to be held up from 100 days to even 300 days in 2018 but now again back to 113 days. That has also improved. Days payable (number of days they take to pay their suppliers) used to be 20 which increased to 80 days and currently at 60 days.

We can say they pay their suppliers later, hold their products in their warehouses for smaller time and receive money much faster from customers. This has happened in last 12 years. This has led to ROCE jumping from 10% to 20%+ while for a year it was negative near -10%.

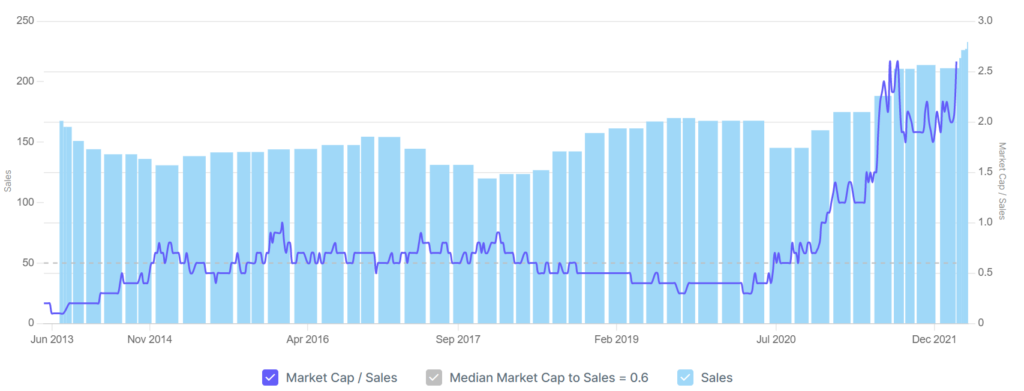

Look how stock has done and working capital days that affect ROCE has impacted the market perception.

Look how market has rerated the market cap to sales (a measure of valuation) from 0.2 times to 2.5 times. That is 10x returns came just from this rerating. Sales has barely gone up 50% in last 10-12 years, but this rerating has led to big gains as stock moved from 8 per share to 418 in 10 years 2012-2022.

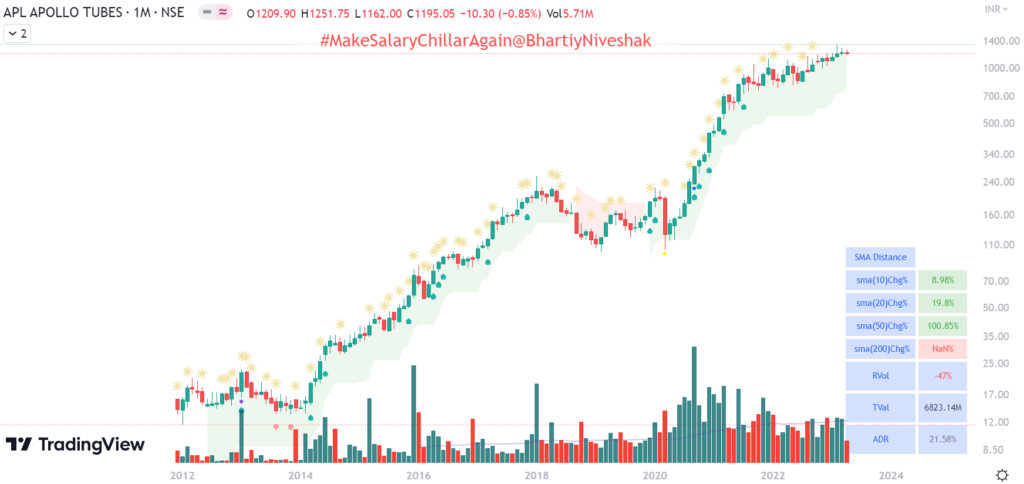

This is Sanjay Gupta run APL Apollo Tubes. Debtor days have been reduced to 10 from 40 while inventory crushed to 30 days from 70 days and days payable from 13 days has increased to 34 days. All of this has led to working capital going from 100 days to 7 days. ROCE jumped from 20% to 35%.

Market rerated it from 0.2 sales to 2 while PE jumped from 5 to 50. That is 10x move due to rerating which came from improving business and perception of market. During this period sales have grown 10-12x. This 10x sales and 10x rerating has led to 100 bagger in 10 years.

Krishna Electrical Industries became KEI Industries later on and you can see in last 5 years working capital days have become half but still ROCE is at similar level. Can you think why and despite no jump in ROCE stock did great. What could explain this.

Stock defied the small cap and mid cap crash that started in 2017 and stock kept making new highs but in Covid fall stock became one third. Since then, stock is close to doing 10x again. In last 7-8 years stock has gone from 100 to 2000. PE went from 10 to 40, market cap to sales during same period went from 0.4 to 2.5. Thus, you can say 4-6x returns came simply due to rerating because of improved perception. Profits became 4x during this period while sales barely trebled.

Lesson: Focus on businesses where working capital management is getting better and that will generally not happen in isolation but will come with good growth in sales and even better profit growth. Such stocks get rerated big time. The twin engine of profit growth and rerating in multiple leads to mega gains.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. We may have positions in the stock mentioned. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.