When market becomes nervous due to some event or uncertainty then it either sees the whole sale sell off or becomes extremely narrow. Either way it becomes extremely difficult to make money specially in limited time duration. This problem accentuates for those looking for bigger trending moves of 50% or more.

Shivalik Bimetal Controls is a company specialized in the joining of material through various methods such as Diffusion Bonding / Cladding, Electron Beam Welding, Solder Reflow and Resistance Welding. Their present program includes Thermostatic Bimetal, Clad Metal, Spring Rolled stainless Steels, Electron Beam Welded Material with multi- Gauge and Multi- Materials strips and Thermostatic Edge- Welded Strips for a board spectrum of industries.

40% revenue is from India and 35% is from America while Europe accounts for 14% of revenue. They are one of the few Indian players in bimetal and low ohmic resistance shunt market. NYSE listed Vishay is one of their top customers.

For shunts they have largest capacity in the world with market share of 10% while in bimetals they have 16% market share. There is client stickiness because of technical knowhow required in this business. End user industry such as EV, electricity smart meters and electrical goods market are growing fast in India. Despite expansion debt to equity is low at 0.3 while ROCE is 35%. But this is highest ROCE at least in last 10 years so we will have to see whether it sustains, or they fall from here. In last three years they have almost doubled the net block (fixed asset). We have talked about this stock in Deepavali 2021. This is a proxy to EV and smart meter focus of government.

We discussed this on Feb 2, 2023, in Pro and since then it has delivered Dec 2022 results which have good growth YoY but flat QoQ. Since market was expecting even more muted result hence stock corrected a lot, but result surprised the market on upside and hence stock came out of falling trendline in dailies. Since it was near upward trending GL (green line) hence it offered low risk entry.

The stock got listed in NSE only in 2021 and hence used BSE chart. This is classic chart to study and learn price action and how it works in bigger time frame over years.

This is a bigger story that is likely to play out over next 2-3 years, but we still have to look at price action to take optimal decision.

There are many ways to play such stocks also. One is to just buy some and then wait for next base to add more and then keep holding as long as big picture things remain intact. Another way is to trade it for burst move lasting few days to few weeks. No one method is correct and it mostly depends on what suits you.

They are a specialist manufacturer and re-filler of Refrigerant gases that are replacements for Chloro-fluoro-carbons. They have business of Coal Ash handling and using reverse logistics for it.

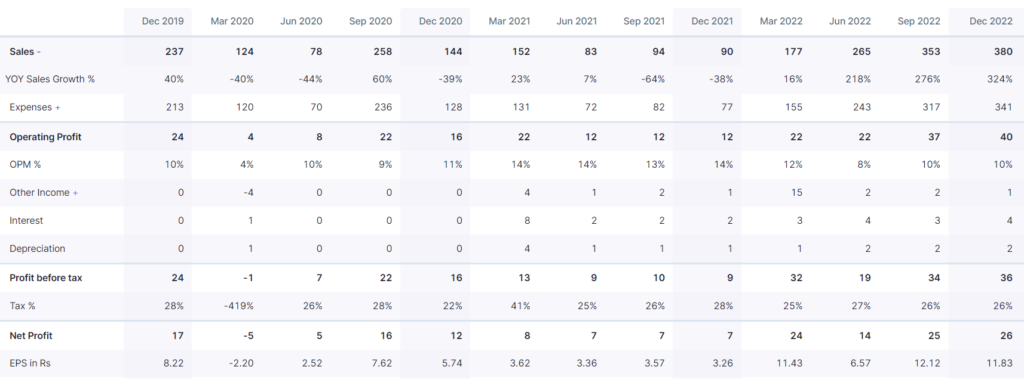

Company is posting blockbuster growth of three digits in sales. In Dec’22, they have posted sales of 380 Cr and PAT of 26 Cr. The company used to have issues in the past and still there is a lot of trade receivables. So you should keep this in mind while dealing with this. SL for this you can use 242.

The company has ROCE in 20s while debt to equity is at .45 and they do not pay dividends. They are currently trading very cheap so if stock becomes huge even from here then do not be surprised given the growth and valuations.

This is the holding company of Ujjivan Small Finance Bank which is also listed but since risk reward was better in holding company hence shared this instead of SFB directly. ROEs are improving, expect the loan growth of 30% in FY23, asset quality can improve further from here.

The bigger news is reverse merger of SFB with holding company to be done by June 2023. More than 4% RoA while ROE is inching towards 30% while it is trading at 2 price to book. Right before Corona the business used to trade above 4 times book value. Ujjivan is best in SFB peers.

Main trend has been downward after three months of listing in 2016. May 2016 it got listed and then moved 150%+ in next three months and since they it had hard time. Interestingly if you notice the lows hit in 2022 Feb-March, are even lower than Corona lows of March 2020 for the stock. Stock is still 35% down from pre corona high which is at 415 levels. It may have changed the trend in Feb 2020 if not for Corona.

As you can see with Russia entering Ukraine stock got hammered and then had big volume up move on March 4 but then it just kept falling and only in April 2022 stock started to run. One should not get excited seeing such moves unless you have strong understanding of business and can withstand volatility. Please add BNP indicator in your tradingview and always look for stocks trading above GL and GL sloping upwards. This happened only by July 2022. Stock was still trading at only 140.

You may have stocks that you understand very well and have understanding of business but if you add just simple concept of GL then you can improve your stock market journey tremendously.

Pennar Industries came out with blockbuster earnings and see how beautifully stock is going up from GL with SBDs.

Nava also reported good numbers, but stock could not do much and you can see on charts why. Now either it dips to 230 then one may add or if it goes past trendline above 255 and sustains.

Ganesha Ecosphere reported good numbers but since more capex is yet to come online and stock is way above GL stock has not reacted to it. The story is intact. Neuland Lab and Centum Electronics have hit the SL but since they are the fundamental picks, they are likely to set up again and some of you may have not exited it and it is fine.

Focus and Choice International were two quick trades shared which are lesser known. Madhusudan Kela has 12% stake in Choice International. Both these stocks have been in insane momentum so be quick to take profits if weakness is seen. Axita has been another quick trade that continues to do well.

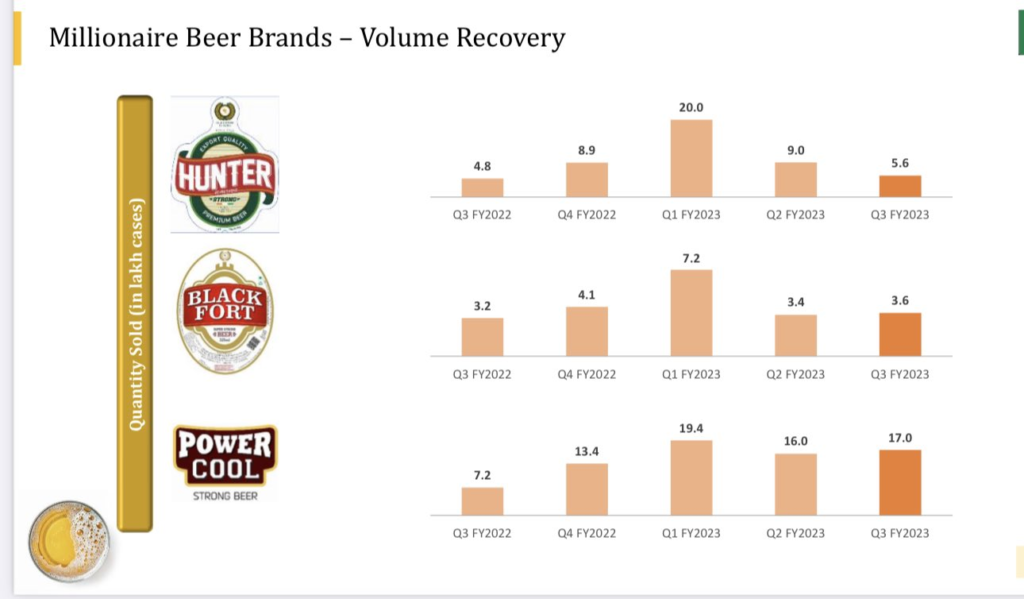

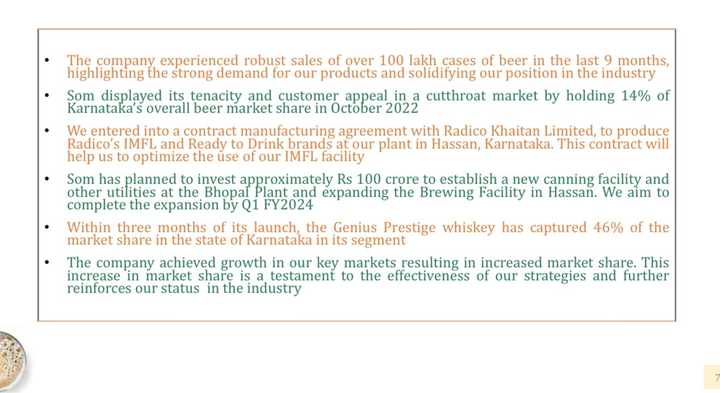

They are into the manufacturing and sale of Beer and Indian Made Foreign Liquor (IMFL).

Stock is trading near GL and offering low risk entry. Promoters although have little over then 30% stake only which seems low for Indian stock, but they have been buying relentlessly from open market over last many months. As soon as stock crosses 125 and closes above it on dailies then it will gather pace. More details in this Slack post.

100 Cr capex in Bhopal & Hasan coming on stream in Feb 2023. Q1FY24 can have much better numbers. Market share gains continue across regions.

This is one of the names where growth is there, capex is coming online, market share gains are happening which company updates via exchange filings, promoters just keep buying shares from open market and valuations are not demanding.

Such stocks reward well because they have all the engines firing. As more capex come online sales grows and with scale comes improvement in gross margins and as capacity utilization climbs up operating leverage kicks in and then market not only makes stock run due to profit growth but gives higher earnings multiple too. That is both earnings growth and growth in multiple (rerating) leads to bigger gains.

If it runs 50% in few months unannounced you should not be surprised. This is a big candidate for rerating.

Hotel as a sector continues to report great numbers and Royal Orchid is something we have talked about multiple times. Stocks like ICEMAKE, Axiscades, Zentec, Gravita, Kabra, PGEL, Speciality Restaurant, TWL/JWL/HBL Power/Kernex from railways, in metal space stocks like VSSL etc. continue to be good. There are themes of water treatment and electrical capital goods that are doing well.

Staying away from Adani stocks and not buying seeing the discount will be wise decision. Whenever some stock lands in controversy then market hammers them out of the shape because market is about perception. Even if some buying due to low float can take them back to old levels reward is not good enough to take the stress there.

Chemical as a sector has suffered a lot and may be a quarter of pain more. A lot of stocks will start becoming attractive soon and we are looking at something like Sudarshan Chemical. There is no structural issue in the sector. A lot of healthcare stocks seem to have bottomed out. Even if you consider large cap pharma stocks which have been battered, they should reward well over next few months. Same is true for paint stocks and so on. We are looking at Marksans and Bajaj Healthcare from small cap pharma space.

Hope you are enjoying being part of Pro and all the learnings that market keeps giving us from time to time. If you have any questions, feel free to ask in comment section.

Disclaimer: Posts on the platforms of BN are our perspective on the market. These are purely meant for learning purposes. The perspective provided should not be construed as investment advice or solicitation to trade. We may have positions in the stock mentioned. You agree to make no trade relying on the above contained information fully or partly. By using the content, you agree to these T&Cs.